Earned Wage Access Adoption Around The World

Through the years Earned Wage Access (EWA), which allows Early access to earned wages before payday, has emerged as a transformative financial service for both employers and employees. This innovative solution addresses a crucial need for financial flexibility and well-being among the global workforce, reshaping the way employees interact with their earnings. With adoption rates increasing across various countries, this is a clear sign that offering daily payroll is about to become the new norm globally.

Global Adoption of EWA

EWA’s adoption globally signifies a shift towards more employee-centered financial services. In developed markets like the United States and the United Kingdom, where EWA services originated, they have gained significant traction, driven by the demands of a workforce seeking greater control over their finances. These regions have seen a proliferation of EWA providers over the last few years, each offering different propositions to integrate with existing payroll systems. The U.S., in particular, has a vibrant landscape of EWA solutions, with companies like Tapcheck, and many more, offering instant access to earned wages with minimal fees.

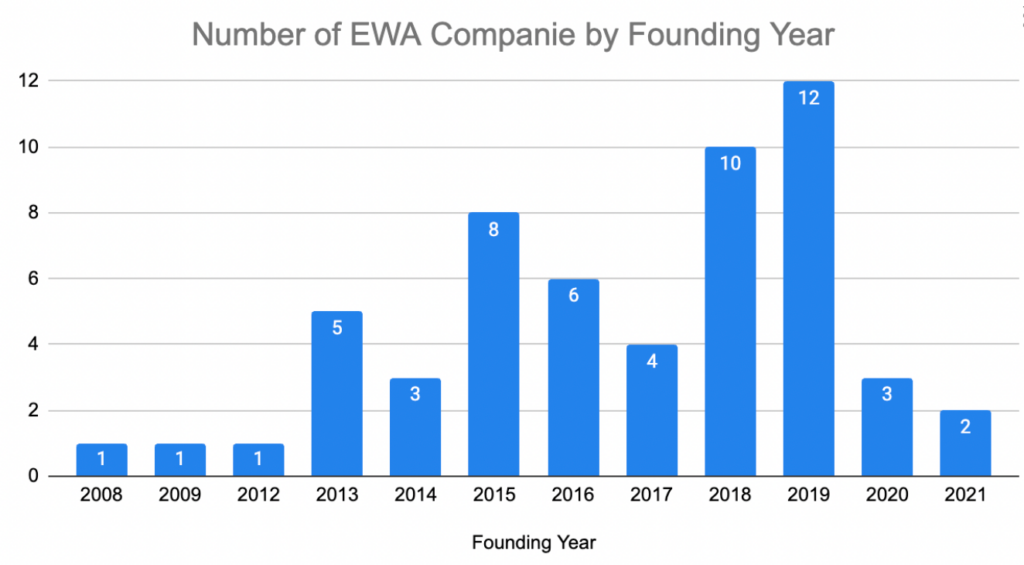

In recent years, the financial landscape has seen a significant shift with the rise of Earned Wage Access (EWA) services, a movement that gained considerable momentum in 2019. This year marked a peak in the funding of new EWA companies, signifying a global acknowledgment of the need for such services. Particularly notable is the expansion into emerging markets, where countries like India and Vietnam are beginning to adopt EWA solutions to combat financial exclusion and mitigate the risks associated with high-interest loans.

The adoption of EWA services is not just a trend but a response to a growing demand from both employers and employees seeking more flexibility and control over their earnings. Although the concept of daily access to earned wages is not yet a universal reality, efforts are intensifying to make it commonplace. In the United States alone, the prevalence of companies offering EWA has surged from 5% in 2021 to 20% in 2023, according to estimates by hr.com.

| Country | Name & Link | Founding Year |

| United States | FlexWage | 2009 |

| United States | PayActiv | 2012 |

| United States | Earnin | 2013 |

| Malaysia | Bayzat | 2013 |

| United States | Even | 2014 |

| Ghana | Zeepay | 2014 |

| United States | Zayzoon | 2014 |

| United States | DailyPay | 2015 |

| United States | Branch | 2015 |

| Canada | Instant Financial | 2015 |

| India | EarlySalary | 2015 |

| Singapore | HReasily | 2015 |

| New Zealand | PaySauce | 2015 |

| South Korea | Toss | 2015 |

| Philippines | Sprout Solutions | 2015 |

| India | PayMe India | 2016 |

| UAE | Now Money | 2016 |

| Nigeria | Flutterwave | 2016 |

| Turkey | Papara | 2016 |

| Bangladesh | ShopUp | 2016 |

| United States | Rain | 2016 |

| Mexico | Minu | 2017 |

| Kenya | Workpay | 2017 |

| Sweden | Anyfin | 2017 |

| Thailand | Pandai | 2017 |

| United Kingdom | Wagestream | 2018 |

| United Kingdom | Earnd | 2018 |

| France | Wage | 2018 |

| Egypt | Paynas | 2018 |

| Poland | Symmetrical.ai | 2018 |

| Argentina | ViViPay | 2018 |

| Colombia | Movii | 2018 |

| Sri Lanka | DirectPay | 2018 |

| United States | OrbisPay | 2018 |

| United States | Immediate | 2018 |

| Australia | MyPayNow | 2019 |

| United States | Tapcheck | 2019 |

| Australia | Beforepay | 2019 |

| South Africa | SmartWage | 2019 |

| Spain | Payflow | 2019 |

| Philippines | Advance | 2019 |

| Belgium | Payflip | 2019 |

| Finland | Omnipresent | 2019 |

| Chile | Tenpo | 2019 |

| Indonesia | Wagely | 2019 |

| Vietnam | Gimo | 2019 |

| United States | Clair | 2019 |

| Italy | Heny | 2020 |

| India | Jify | 2020 |

| India | Refyne | 2020 |

| Pakistan | Abhi | 2021 |

| Vietnam | Vui App | 2021 |

EWA Operational Models

EWA operates under two primary models: employer-sponsored and direct-to-employee.

The employer-sponsored model, where the EWA is integrated into their payroll and/or timeclock systems, has seen considerable adoption in countries with robust regulatory frameworks and financial infrastructure, like in the U.S. This model emphasizes the role of EWA as an employee benefit, enhancing employer branding and talent retention by offering financial wellness solutions as a perk.

The direct-to-employee model, on the other hand, allows individuals to access their earned wages through third-party apps, with varying degrees of fees and terms. This model is particularly prevalent in regions with a significant gig economy workforce, offering flexibility and immediacy to individuals who work irregular hours or on a project basis. However, because the direct-to-employee model usually doesn’t rely on live employment data from sources like a payroll or timeclock provider, they usually offer much lower limits for withdrawal and with higher fees compared to the employer-sponsored model. Furthermore, those using these services are at much higher risk of overdraft and the fees that go with it and potentially leave the user in debt.

Benefits for Employees

The benefits of EWA for employees are manifold, transcending geographical and cultural differences. Firstly, EWA offers financial flexibility, allowing workers to manage unexpected expenses without resorting to high-interest loans or credit card debt. This is particularly impactful in countries with limited access to affordable credit, where EWA can serve as a lifeline in times of financial distress.

Secondly, EWA promotes financial well-being and literacy. By providing content for financial literacy, EWA apps can help users learn how to make informed financial decisions, encouraging savings and responsible spending. This aspect of EWA is crucial in fostering a culture of financial awareness and independence, especially among younger generations entering the workforce.

Finally, EWA enhances employee satisfaction and loyalty. By addressing a critical aspect of employees’ lives—their financial health—employers can demonstrate a commitment to their well-being, leading to improved retention rates and a positive workplace culture. This is evident in countries with competitive labor markets, where EWA is increasingly becoming a differentiator in attracting and retaining talent.

Benefits for Employers

Adopting Earned Wage Access (EWA) presents significant advantages for employers, playing a crucial role in enhancing workforce management and company culture. Here’s a condensed overview:

- Talent Attraction and Employer Branding: EWA positions a company as a forward-thinking employer that prioritizes employee financial wellness, making it more attractive to top talent.

- Increased Retention and Loyalty: Providing financial flexibility through EWA reduces employee turnover by alleviating financial stress and fostering a sense of loyalty towards the employer.

- Enhanced Productivity: Financial stress can distract employees and reduce workplace productivity. EWA allows employees to concentrate on their jobs rather than financial worries, leading to higher engagement and output.

- Financial Wellness Support: Alongside EWA, employers can offer tools for financial education and management, often as part of the same service, therefore promoting a healthier approach to personal finance among employees.

Conclusion

The adoption of Earned Wage Access across different countries reflects a growing recognition of the need for financial services that align with the modern workforce’s expectations of flexibility, immediacy, and well-being. While the implementation and impacts of EWA vary globally, its core proposition remains consistent: providing employees with control over their finances, thereby fostering a more engaged, productive, and financially secure workforce. As EWA continues to evolve, its integration into global payroll practices promises to redefine the traditional pay cycle, making financial wellness an achievable goal for workers worldwide.

Source: